The CFMEU National Construction Division is aware of the risks of Covid-19 (Coronavirus), and it is our absolute priority to keep all our members safe, healthy and employed.

On the advice of the Chief Health Officers and authorities around the country, construction sites remain open. We are working with builders and authorities to keep it this way as long as it is safe to do so.

Maintaining the health and safety of construction workers is our absolute priority during this pandemic crisis. We need the entire industry to act responsibly and collectively to minimise the risk of infection on worksites.

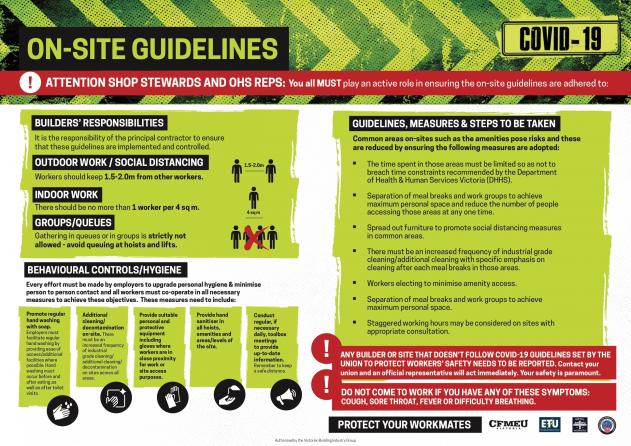

Sites are required to carry out safety precautions to limit the risk of Covid-19.

Workers must be able to maintain a distance of 1.5 to 2 metres apart when doing outdoor work and there must be no more than 1 worker per 4 sq m when doing indoor work.

Gathering in queues or groups is strictly not allowed. There should be no queuing at hoists and lifts.

Common and amenities areas must not have more people in them than is allowed under government guidelines. Amenities areas and break rooms must be kept thoroughly clean and decontaminated between use.

Workers need to wash their hands regularly with soap.

Any worker experiencing employment issues or threats of stand downs should contact the union for advice and support immediately.

Measures employers must take include:

- Upgrade personal hygiene practices onsite and ensure there are enough hand wash / sanitisation stations for the number of workers onsite

- Ensure social distancing restrictions are followed. This may require staggered start times and meal breaks to ensure limits on numbers of people in one place are met

- Minimise person-to-person contact

- Promote regular hand washing with soap. Hand washing must occur before and after eating, as well as after toilet visits

- Provide ease of access/additional facilities where possible

- Additional decontamination and industrial-grade cleaning across all areas on-site, especially amenities areas and break rooms

- Provide gloves and other suitable personal and protective equipment where needed

- Provide hand sanitiser in all hoists, amenities and areas/levels

- Conduct regular, if necessary daily, toolbox meetings to provide up-to-date information. Remember to keep a safe distance.

Measures workers must take include:

- Maintain a distance of 1.5 to 2 metres apart at all times

- Wash hands regularly with soap

- Do not queue at hoists and lifts

- Minimise use of common spaces to avoid crowding

- Observe the social distancing guidelines during meal breaks and smokos. Do not congregate together

- DO NOT COME TO WORK IF YOU HAVE ANY OF THESE SYMPTOMS:

COUGH, SORE THROAT, FEVER OR DIFFICULTY BREATHING. See the FAQs below for more information.

Measures delegates must take include:

- Ensure employers are providing measures outlined above and on the COVID-19 On-Site Guideline distributed by the union.

- Conduct regular toolbox meetings to provide up-to-date information

- Ensure toolbox meetings are conducted safely according to the social distancing guidelines

Remember:

If you have symptoms, you must inform the employer and the union and you must stay home.

If your site management is not taking extra precautions, speak to your delegate or your state branch immediately.

Any worker experiencing employment issues or threats of stand downs should contact the union for advice and support.

This is an evolving situation that we are keeping a close eye on, and we will let you know of changes as they occur.

CFMEU Construction State and Territory branches

ACT – NSW – QLD/NT – SA – VIC/TAS – WA

Useful resources

COVID-19 On-site Guidelines

On-site guidelines for OHS Reps, Shop Stewards and Delegates – A3 Poster

COVID-19: Building Industry Guidelines – Victoria

FAQs

Disclaimer: This is general guidance only.

ALWAYS CONTACT THE UNION TO OBTAIN EMPLOYMENT ADVICE THAT IS SPECIFIC TO YOU AND YOUR WORKPLACE

1. I have COVID-19. What should I do?

2. I have symptoms which are consistent with COVID-19. What should I do?

3. I have had close contact with someone who has COVID-19. What should I do?

4. I have had casual contact with someone who has COVID-19

5. Someone at my workplace has been diagnosed with COVID-19, or is showing symptoms. What should I do?

6. I do not have COVID-19 but I do not want to come to work. What should I do?

7. My child’s school / childcare has shut down and I have to look after my children. What do I do?

8. Someone in my household has been diagnosed with COVID-19 and I need to look after them. What do I do?

9. If I am required to self-quarantine and cannot work, do I get paid?

10. I am worried that my employer is not taking adequate steps to make the workplace safe. What should I do? Can I refuse to work?

11. Can my employer send me home due to high temperature or illness?

12. In what circumstances can my employer shut the site and stand workers down if the government has not directed it to shut down?

13. What happens if the government directs my employer to shut down the site?

14. Will I get paid if I am stood down?

15. I am a casual. Will I be paid if I am stood down / my site closes?

16. What is the government’s Job Keeper program and can I get payments through it?

17. I am an independent contractor / on an ABN and I have no work or less work. What can I do?

18. My boss says I will be made redundant. What should I do?

19. I’m still employed but I’m not getting paid normally. What can I do?

20. I’ve been sacked. What financial assistance is available?

21. Can I get workers compensation benefits if I get COVID-19 at work?

22. Can I access my redundancy entitlement if I’m not receiving wages but still employed?

- I have COVID-19. What should I do?

- If you have a confirmed case of COVID-19, you must not attend work. Follow all medical advice provided by your health care practitioner and the relevant government agency. This will include a 14-day self quarantine period;

- Positive tests should be immediately communicated to your employer and the union;

- All workers on your site should be fully informed as soon as possible. Contact your HSR and the Union to ensure that an appropriate mapping exercise is undertaken to identify who the affected worker has had close or casual contact with, and where the worker has been on site;

- You will be able to use any entitlement to accrued, paid personal / carer’s (sick) leave. If you do not have accrued paid leave, you can access unpaid carer’s leave for the period you are unfit for work;

- If you do not have any accrued, paid leave or are a casual employee other options include:

- check your EBA, superannuation and portable redundancy funds to see if you are entitled to any income protection insurance;

- check with your portable redundancy fund (Incolink, ACIRT, BIRST etc). Many of these funds have announced additional measures including hardship payments to assist affected workers;

- Ask your employer in writing to provide special paid leave to cover the period of isolation with a clear explanation of why the isolation is necessary. Remind them that it is the employer’s responsibility to provide a safe workplace for all workers – but it can’t be your cost to bear. If they do not agree to the request, contact your union delegate or organiser as soon as possible;

- See question 19 below in relation to options where you are not receiving your normal wage

- I have symptoms which are consistent with COVID-19. What should I do?

- The symptoms of COVID-19 include shortness of breath, fever, sore throat and coughing. If you have these symptoms do not attend work;

- If you are at work on onsite and experience symptoms, immediately tell your employer, call the union, leave work and call the National Coronavirus Helpline on 1800 020 080 and / or seek immediate medical assistance;

- Seek a test and remain in self-isolation until test results are available;

- If you cannot get access to a COVID-19 test and there is doubt, you should self-isolate for 14 days;

- If you undertake a test and it comes back:

- Negative (you don’t have COVID-19), tell your employer – they should facilitate an immediate return to work;

- Positive (you do have COVID- 19), tell your employer and HSR. Your employer should facilitate an return to work following the self-isolation period.

- Employers cannot request or direct any worker in self-isolation, quarantine or with symptoms of COVID-19 to attend work;

- You may access paid personal / carer’s leave. If you do not have any paid leave available, you can access unpaid leave;

- If you do not have any accrued, paid leave or are a casual employee other options include:

- Check with your portable redundancy fund (Incolink, ACIRT, BIRST etc).. Many of these funds have announced additional measures to assist affected workers including hardship payments;

- Check your EBA, superannuation and portable redundancy funds to see if you are entitled to any income protection insurance;

- Ask your employer in writing to provide special paid leave to cover the period of isolation with a clear explanation of why the isolation is necessary. Remind them that it is the employer’s responsibility to provide a safe workplace for all workers, and directing or permitting a worker to remain home is a valid administrative control for the hazard – but it can’t be your cost to bear. If they do not agree to the request, contract your union delegate or organiser as soon as possible.

- See question 19 below in relation to options where you are not receiving your normal wage

- I have had close contact with someone who has COVID-19. What should I do?

- If you have had close contact with a person who has been diagnosed, you must self-quarantine at home;

- Close contact is defined as:

- spending more than 15 minutes face-to-face; or

- sharing a closed space for more than 2 hours

with a person who is a confirmed case in the 24 hours before they showed symptoms, until they are no longer considered to be infectious by health professionals;

- If you are self-quarantined but otherwise well (and showing no symptoms), you can ask your employer to take any accrued annual leave, RDOs or long-service leave, or take unpaid leave. If you become unwell, you can access personal / carer’s leave;

- See question 19 below in relation to options where you are not receiving your normal wage

- I have had casual contact with someone who has COVID-19

- Casual contact is defined as:

- spending less than 15 minutes face-to-face; or

- sharing a closed space for less than 2 hours

with a person who is a confirmed case in the 24 hours before they showed symptoms, until they are no longer considered to be infectious by health professionals;

- If you have had casual contact, but do not have any symptoms of COVID-19 (fever, shortness of breath, sore throat, coughing) then you can continue to attend work but monitor yourself carefully for 14 days;

- If you develop symptoms you should immediately notify your employer, leave work, and call the National Coronavirus Helpline on 1800 020 080 and / or seek immediate medical assistance

- Someone at my workplace has been diagnosed with COVID-19, or is showing symptoms. What should I do?

- If someone at your worksite has been diagnosed with COVID-19, contact the union immediately. The worker who has been diagnosed must not attend the workplace under any circumstances;

- All workers on site should be fully informed as soon as possible. Contact your HSR and the Union to ensure that an appropriate mapping exercise is undertaken to identify who the affected worker has had close or casual contact with, and where the worker has been on site.

- If someone at work is displaying symptoms but has not been diagnosed and is still at work contact the your HSR or union organiser immediately. If the HSR or the Union determines that the problems are a serious risk to worker health and safety, they may direct affected employees to cease work, including any potentially infected worker. In this case, your employer should continue paying all workers;

- You must perform any available alternative work, so long as it is safe.

- I do not have COVID-19 but I do not want to come to work. What should I do?

- Some workers who are otherwise well may be particularly anxious to attend work, for example where they have a health condition that places them in a high risk category, or a member of their immediate family or household are at high risk;

- If you are voluntarily self-isolating and have access to personal (sick) leave, you should write to your employer seeking their agreement to use your personal leave to cover the period of isolation. If they do not agree to this reasonable request, contact your delegate or organiser as soon as possible;

- If you have accrued, annual leave and you want to take it, your employer cannot refuse a reasonable request to take it. You may also have a paid entitlement to RDOs or long service leave that you could take;

- If you do not have any leave accruals, ask your employer in writing to provide you with special paid leave to cover the period of isolation with a clear explanation of why the isolation is necessary. Remind them that it is the employer’s responsibility to provide a safe workplace for all workers, and directing or permitting a worker to remain home is a valid administrative control for the hazard – but it can’t be your cost to bear. If they do not agree to the request, contract your union delegate or organiser as soon as possible;

- the Union can also put you in contact with counselling and support services;

- See question 19 below in relation to options where you are not receiving your normal wage

- My child’s school / childcare has shut down and I have to look after my children. What do I do?

- If this occurs unexpectedly and you need to collect your child, you can access any paid personal / carer’s leave;

- If you child (or another dependent) is not unwell and you cannot find suitable care, you can come to an agreement with your employer to use any paid leave entitlements. You may also ask to adjust your working hours. Check your EBA. Remember that any reduction in working hours usually requires the employee to agree; if you agree make sure it is in writing and signed by you and your employer.

- Someone in my household has been diagnosed with COVID-19 and I need to look after them. What do I do?

- You will be able to take any accrued personal / carer’s leave. If you do not have any, you can take unpaid leave;

- If you don’t have a paid leave entitlement, ask your employer in writing to provide special paid leave to cover the period of isolation with a clear explanation of why the isolation is necessary. Remind them that it is the employer’s responsibility to provide a safe workplace for all workers, and directing or permitting a worker to remain home is a valid administrative control for the hazard – but it can’t be your cost to bear. If they do not agree to the request, contract your union delegate or organiser as soon as possible;

- If you are in a portable redundancy fund (such as Incolink, ACIRT, BIRST etc) you may be entitled to a hardship payment. Many of these funds have announced additional entitlements as a response to COVID-19;

- You could talk to your employer about taking other accrued leave (annual leave, long service leave). You can ask you employer if you can take any paid leave over a longer period at reduced pay;

- See question 19 below in relation to options where you are not receiving your normal wage

- If I am required to self-quarantine and cannot work, do I get paid?

- If you have an entitlement to accrued paid personal / carer’s leave, you will be able to use it. If you don’t have accrued paid leave, you are entitled to unpaid personal / carer’s leave for the period you are unfit for work;

- If you don’t have a paid leave entitlement, ask your employer in writing to provide special paid leave to cover the period of isolation with a clear explanation of why the isolation is necessary. Remind them that it is the employer’s responsibility to provide a safe workplace for all workers, and directing or permitting a worker to remain home is a valid administrative control for the hazard – but it can’t be your cost to bear. If they do not agree to the request, contract your union delegate or organiser as soon as possible;

- Check your EBA and superannuation fund to see whether you have an entitlement to income protection insurance;

- If you have annual leave banked and want to take it, your employer cannot refuse a reasonable request to take it. If you ask, your employer can agree to take annual leave at half pay for a longer period;

- You may also want to access any accrued, untaken RDOs or long service leave;

- If you are in a portable redundancy fund (such as Incolink, ACIRT, BIRST etc) you may be entitled to a hardship payment. Many of these funds have announced additional entitlements as a response to COVID-19;

- If you do not have access to paid leave or other pay, the Government’s Job Seeker payment (formerly Newstart) is available for workers between 22 and Aged Pension age and can be access where a person is

- not able to work (sick or injured) or don’t have work. This includes workers who have been stood down or lost their job and includes casual and contract workers whose income has been reduced;

- is in isolation or hospitalised;

- is caring for children or for someone else who is affected by coronavirus

The payment is up to $1,100 per fortnight (before tax), and paid by Centrelink. The usual eligibility criteria has been temporarily waived for certain payments including the assets test and the ordinary waiting period. Income testing will still apply, but partner income test relaxed – you partner can earn up to $79,762.

To apply go to www.my.gov.au/services. For more information go to www.servicesaustralia.gov.au/individuals/services/centrelink/jobseeker-payment/how-claim

- I am worried that my employer is not taking adequate steps to make the workplace safe. What should I do? Can I refuse to work?

- Contact your HSR and the Union if you think there is a serious risk of exposure to COVID-19

- Your HSR / the Union will negotiate improvements to the site with the employer or site controller;

- If the HSR or the Union determines that the problems are a serious risk to worker health and safety, they may direct affected employees to cease work, including any potentially infected worker. In this case, your employer should continue paying all workers;

- All affected workers must perform any available alternative work, so long as it is safe

- Can my employer send me home due to high temperature or illness?

- If you are ill or have a high temperature, you should not go to work. Notify your employer over the phone; do not attend the workplace. If you have access to personal (sick) leave, take it in the first instance;

- If you are directed to leave site but you feel fine and are able and willing to work, your employer may be implementing a control measure under Work Health and Safety legislation. Employers can direct workers to stay home if they are sick or at risk of infection, but the direction must be reasonable (based on factual information about genuine health and safety risks). Workers also have a duty to take reasonable care of their own health and safety and the health and safety of other workers;

- BUT employers are not entitled to stand employees down without pay if a worker is able and willing to work. If you are given a reasonable direction in these circumstances, you are entitled to be paid for your normal working hours that day. You should not be required to take annual leave, personal leave or long service leave;

- If you obtain a medical certificate clearing you to return to work, the employer should allow you to return to work.

- In what circumstances can my employer shut the site and stand workers down if the government has not directed it to shut down?

- If you have been stood down, or your workplace shuts down, contact the union immediately;

- If there is no government direction which requires the site to close, there are only very limited circumstances where employers can shut down sites and “stand down” workers. Stand down is a reference to where work stops and employees are not working but are still employed;

- Under the Fair Work Act 2009 workers can be stood down only in certain circumstances, where:

- there is a stoppage of work; and

- the employer cannot reasonably be held responsible for the stoppage of work; and

- workers cannot usefully be employed.

- This is a high bar. Your employer cannot stand you down just because there is a slow-down in work or the company is losing money or making less of a profit. However, employers may be able to legitimately stand workers down where (for example):

- an overwhelming part of the workforce is required to self-quarantine, and because of this the remaining workers cannot be usefully employed (BUT if there is safe work available, workers should not be stood down – you can perform work that you do not usually do); or

- work stops because building materials cannot be supplied for a reason that it outside of your employers control related to COVID-19; or

- local travel restrictions or exclusion zones prevent workers from accessing the site.

- Also check you EBA for any provisions which allows your employer to stand workers down. Contact the union if you do not have a copy of your EBA, or if you do not know if you have one. You may also have a letter of offer or written contract (usually given to you when you started with the company) that may contain provisions that relate to stand down;

- BEFORE ANY CLOSURE employers must consult with the union and workers before standing anyone down.

- is there other work available that can be done safely?

- can workers be relocated to another site?

- is there paid training available?

- can working hours be adjusted or can workers do part-time work? (Note that employers must also consult with the union and members about changes to regular rosters or ordinary hours of work, and changes to start and finish times. Reducing employee’s hours usually requires workers to agree)

- If your employer has not consulted and has not considered whether alternative work is available, then the stoppage is not genuinely outside their control and they should pay you as normal;

- If your employer consults and there is no alternative work is available, your employer needs to prepare a clear and reasonable process for workers to obtain access to entitlements. Access to any government entitlements (under the Job Keeper scheme – see question 16 below) should be accessed before any paid leave entitlements;

- Your employer must also consult with the union and workers about the reopening of sites, to ensure that workers are able to return on a fair and reasonable basis.

- IFTHERE IS A STAND DOWN contact the Union. The Union can run disputes in the Fair Work Commission (or a disputes board in some states) if the stand down does not meet the relevant legal requirements, or if your employer has not properly consulted. If you are stood down unlawfully, you may be able to recover unpaid wages.You can look for other work while you are stood down, but it’s a good idea to keep your employer informed if you take another job.

- What happens if the government directs my employer to shut down the site?

- If the government directs work to stop, or you lose access to the site because of a government ordered lock-down, your employer must consult with the Union and workers. If a government direction is given on short notice, consultation prior to the decision may not be possible but your employer still has a responsibility to consult;

- Firstly, consultation must occur in relation to alternatives to standing down workers. For example:

- Can workers be re-deployed to another site that is not affected by the direction?

- Can any arrangements be made so that work can continue?

- Is paid training available?

- Is it possible for any workers to work from home?

- If no alternate work is available, employers must consult on a clear and reasonable process for workers to obtain access to entitlements. They must also consult with the union and workers to ensure that, when the site is reopened, the same workforce is returned to work on a fair and reasonable basis;

- See question 19 below in relation to options where you are not receiving your normal wage;

- You can look for other work while you are stood down / your site is shut, but it’s a good idea to keep your employer informed if you take another job.

- Will I get paid if I am stood down?

- “Stand down” is where workers remain employed, but cannot work. Work must have stopped for a reason outside of the employer’s control, and workers cannot be usefully employed (see questions 12 and 13 for when employees can be stood down). If this has not happened, you should be paid as normal;

- Employers are generally not obliged to pay employees their regular wage when they are stood down. However:

- your employer may be able to make an application to the ATO for the Job Keeper scheme (see question 16 below), which pays a subsidy to employers to keep workers employed. Access to any government entitlements) should be accessed before workers are required to access any paid leave entitlements;

- if you have accrued annual leave and want to take it, employers cannot reasonably refuse the request. You may want to ask to access your leave at half pay over a long period. Some employers may agree to workers taking paid annual leave in advance before it has accrued;

- you may also want to take any accrued, untaken RDOs or any time off in lieu that you have banked;

- check your EBA, superannuation and portable redundancy funds to see if you are entitled to any income protection insurance;

- if you are in a portable redundancy fund (such as Incolink, ACIRT, BIRST etc) you may be entitled to a hardship payment. Many of these funds have announced additional entitlements as a response to COVID-19;

- you may want early access to superannuation, but this should be a last resort. Workers affected by COVID-19 can access up to $10,000 in 2019-2020 year, and up to $10,000 in 2020-2021 year. Individuals will not need to pay tax on amounts released and the money they withdraw will not affect Centrelink or Veterans’ Affairs payments. Applications can be made from April 2020. Contact your superannuation fund to discuss this option.

- You will continue to accrue annual leave and personal (sick) leave while you are stood down.

- I am a casual. Will I be paid if I am stood down / my site closes?

- Casuals are generally not entitled to paid leave;

- If you were employed on a regular basis for at least one year as at 1 March 2020 your employer may be able to make an application under the Federal Government’s Job Keeper program – see question 16;

- Check your EBA, superannuation and portable redundancy funds to see if you are entitled to any income protection insurance;

- If you are in a portable redundancy fund (such as Incolink, ACIRT, BIRST etc) you may be entitled to a hardship payment. Many of these funds have announced additional entitlements as a response to COVID-19;

- You may want early access to superannuation, but this should be a last resort. Workers affected by COVID-19 can access up to $10,000 in 2019-2020 year, and up to $10,000 in 2020-2021 year. Individuals will not need to pay tax on amounts released and the money they withdraw will not affect Centrelink or Veterans’ Affairs payments. Applications can be made from April 2020. Contact your superannuation fund to discuss this option;

- If you are not eligible for Job Keeper because you have not worker for your employer for a year, the government has also doubled the Job Seeker payment (formerly Newstart) to $1,100 per fortnight (before tax). This is available through Centrelink for workers between 22 and Aged Pension age, where a worker is not able to work (sick or injured) or don’t have work. This includes casuals whose income has been reduced.The usual eligibility criteria has been temporarily waived for certain payments including the assets test and the ordinary waiting period. Income testing will still apply, but partner income test relaxed – partner can earn up to $79,762.To apply go to www.my.gov.au/services. For more information go to www.servicesaustralia.gov.au/individuals/services/centrelink/jobseeker-payment/how-claim

- What is the government’s Job Keeper program and can I get payments through it?

- The Job Keeper program is the Federal Government’s subsidy which it will pay to employers in certain circumstances to keep workers employed during the COVID-19 pandemic;

- Employers must make applications on behalf of workers, and then forward the payment on to employees. If you are an employee, you cannot make an application on your own behalf. Contact your employer and the Union to find out if your employer is making an application on your behalf;

- The subsidy if $1500.00 per fortnight before tax, per employee. It will be payable for up to 6 months. Payments are made to your employers monthly by the ATO;

- Employers can register interest from 30 March 2020, initial payments will be made from the first week of May 2020;

- To be eligible:

-

- employers must be able to show a reduction in turnover of more than 30% relative to a comparable period of at least a month from a year ago, or a 50% reduction if the company has a turnover of more than $1 billion;

- employees have to be:

- over 16;

- employed on 1 March 2020;

- still employed (including those stood down or fired and re-hired);

- if you are a casual employee, you need to have been employed on a regular basis for at least one year (as at 1 March 2020).

-

- What you will receive if you are eligible:

- If you are still working and ordinarily receive $1,500 or more in income per fortnight before tax, you will continue to receive your regular income according to the ‘prevailing workplace arrangements’. The JobKeeper Payments will subsidise part or all of your income;

- If you are still working and ordinarily receive less than $1,500 in income per fortnight before tax, your employer must pay you, at a minimum, $1,500 per fortnight, before tax;

- If you have been stood down, your employer must pay you – at a minimum – $1,500 per fortnight, before tax. Your employer can, but it not obliged to top up your income to what you would normally receive;

- If you were employed on 1 March 2020, subsequently ceased employment and then were re-engaged by the same eligible employer, you will receive, at a minimum, $1,500 per fortnight, before tax.

- If you have more than one job / employer, only one of them can make an application. You will need to notify your main employer to claim the subsidy on your behalf;

- If you are working in Australia on a visa, you will need to notify your employer of your visa status to find out whether you are eligible.

- I am an independent contractor / on an ABN and I have no work or less work. What can I do?

- The Federal Government’s Job Keeper scheme applies to sole-traders, self-employed people and contract workers whose income has reduced;

- The Job Keeper subsidy is $1500 per fortnight (before tax) and is payable for up to 6 months. Payments will be made monthly into you nominated bank account;

- To be eligible you will need to:

- be able to show a reduction in turnover of more than 30% relative to a comparable period of at least a month ago from a year ago;

- provide an ABN and tax file number;

- provide a declaration as to recent business activity;

- give monthly updates to ATO to declare continued eligibility

- You can register interest from 30 March 2020. Initial payments will be made from the first week of May 2020;

- You can register your interest at https://www.ato.gov.au/general/gen/JobKeeper-payment

- My boss says I will be made redundant. What should I do?

- Contact the union. Redundancies should be a last resort, and they need to be genuine;

- Your employer needs to consult with the union and workers to consider whether there are any options for re-deployment within the business or associated businesses;

- If you were employed on 1 March 2020, your former employer may be able to access the Job Keeper payment if you are re-hired (see question 16 above). Contact the union, and your employer, to see if they have considered this;

- Contact your portable redundancy fund (such as Incolink, ACIRT, BIRT, BIRST etc).

- I’m still employed but I’m not getting paid normally. What can I do?

- If you are still performing work, you must be paid. Contact the union immediately;

- If your boss has sent you home without pay and you are a permanent (not casual) employee, you should still be paid your regular (base) rate unless work has stopped at the site and workers have been stood down (see questions 12 and 13);

- If work has slowed or if you have been stood down then options you may want to discuss with your employer include:

- check that your employer has applied to the Job Keeper program (see question 16);

- you can take annual leave. If you have annual leave accrued and you want to take it, your employer cannot refuse a reasonable request that you be able to take it. You may want to ask to take annual leave over a longer period at half pay;

- you may also want to want to access any accrued RDOs or long service leave if you have them;

- contact your portable redundancy fund (such as Incolink, ACIRT, BIRST etc) – you may be entitled to a hardship payment. Many of these funds have announced additional entitlements as a response to COVID-19;

- check your EBA to see whether you have an entitlement to income protection insurance. You may also have insurance through your superannuation fund;

- You may want early access to superannuation. Workers affected by COVID-19 can access up to $10,000 in 2019-2020 year, and up to $10,000 in 2020-2021 year. Individuals will not need to pay tax on amounts released and the money they withdraw will not affect Centrelink or Veterans’ Affairs payments. Applications can be made from April 2020. Contact your superannuation fund to discuss this option.

- I’ve been sacked. What financial assistance is available?

- If you were employed on 1 March 2020, your former employer may be able to access the Job Keeper payment if you are re-hired (see question 16 above). Contact the union, and your employer, to see if you can be re-hired with the subsidy;

- Check your EBA to see whether you have an entitlement to income protection insurance. You may also have insurance through your superannuation fund;

- Contact your portable redundancy fund (such as Incolink, ACIRT, BIRST etc) – you may be entitled to a hardship payment and your regular balances. Many of these funds have announced additional entitlements as a response to COVID-19;

- The government has also doubled the Job Seeker payment (formerly Newstart) to $1,100 per fortnight (before tax). This is available for workers between 22 and Aged Pension age through Centrelink where a worker:

- is not able to work (sick or injured) or don’t have work. This includes workers who have been stood down or lost their job and includes casual and contract workers whose income has been reduced;

- is in isolation or hospitalised;

- is caring for children or for someone else who is affected by coronavirus

The usual eligibility criteria has been temporarily waived for certain payments including the assets test and the ordinary waiting period. Income testing will still apply, but partner income test relaxed – partner can earn up to $79,762.

To apply go to www.my.gov.au/services. For more information go to www.servicesaustralia.gov.au/individuals/services/centrelink/jobseeker-payment/how-claim

- If you are already receiving Centrelink benefits / income support payments (such as JobSeeker, Youth Allowance or Sickness Allowance) you should also be eligible for:

- the Coronavirus supplement, which is $550 (before tax) on top of existing support payments. This should be automatically applied from 27 April 2020 and will continue to be paid each fortnight for 6 months;

- Household payments from Centrelink, if you were receiving an eligible payment (including social security, veteran and other income support) on any day from 12 March to 13 April. This is two separate payments of $750. The first will be made from 31 March 2020 and should be automatically made. The second payment will be made from 13 July 2020, but you cannot receive the second payment as well as the Coronavirus supplement.

For more information go to www.dss.gov.au;

- You may want early access to superannuation. Workers affected by COVID-19 can access up to $10,000 in 2019-2020 year, and up to $10,000 in 2020-2021 year. Individuals will not need to pay tax on amounts released and the money they withdraw will not affect Centrelink or Veterans’ Affairs payments. Applications can be made from April 2020. Contact your superannuation fund to discuss this option.

- Can I get workers compensation benefits if I get COVID-19 at work?

- Workers who contract COVID-19 at work will be able to claim workers’ compensation benefits for any time lost or medical care required. However, it may be challenging to prove the required connection with work because of the growing number of community infections (e.g. you need to be able to reasonably prove that you got it at work, and not anywhere else);

- Keep track of any potentially affected people who you have come into contact with in the workplace;

- Contact the union for assistance if you are unable to work due to a COVID-19 infection caused by work.

- Can I access my redundancy entitlement if I’m not receiving wages but still employed?

- Usually access to redundancy entitlements are only available if employments ends (it doesn’t end if you are stood down because work has stopped; see questions 12 and 13 above);

- However, check with the union or your fund. Many redundancy funds are implementing hardship payments to assist workers affected by COVID-19.

* Coronavirus image used courtesy of: CDC/ Alissa Eckert, MS; Dan Higgins, MAMS